Options

Definition

Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date.

Types of Options

Underlying type: futures options, futures spread options, equity options, fx options, interest rate options

Payout Type: call, put, exotic

Settlement Type: cash settled, delivery

Exercise Time: European, American, Bermudan

Pricing Basics

How to determine option value?

Understanding option greeks

Option Specifications

In order to understand vanilla options pricing, we need to look at the following features:

- Strike price

- The specified price at which the underlying asset can be bought or sold

- Time to expiration

- The amount of time remaining until the option expires

Market data

Price of the underlying asset

Volatility of the underlying asset

- How much the price of the underlying asset is expected to fluctuate

These factors are used to calculate the theoretical value of an option using a mathematical model such as the Black-Scholes model. However, the actual price of an option may also be influenced by supply and demand in the market.

Example

- Strike: 100

- Time to expiration: 1 year

- Interest rate: 0%

- Volatility: 30%

Option Price and Payoff Charts

Numerical Result

| Underlying Price | Call Payoff | Put Payoff | Call Price | Put Price | Call Delta | Put Delta | Gamma | Theta |

|---|---|---|---|---|---|---|---|---|

| 1.00 | 0.00 | 99.00 | 0.00 | 99.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 2.00 | 0.00 | 98.00 | 0.00 | 98.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 3.00 | 0.00 | 97.00 | 0.00 | 97.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 4.00 | 0.00 | 96.00 | 0.00 | 96.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 5.00 | 0.00 | 95.00 | 0.00 | 95.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 6.00 | 0.00 | 94.00 | 0.00 | 94.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 7.00 | 0.00 | 93.00 | 0.00 | 93.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 8.00 | 0.00 | 92.00 | 0.00 | 92.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 9.00 | 0.00 | 91.00 | 0.00 | 91.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 10.00 | 0.00 | 90.00 | 0.00 | 90.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 11.00 | 0.00 | 89.00 | 0.00 | 89.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 12.00 | 0.00 | 88.00 | 0.00 | 88.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 13.00 | 0.00 | 87.00 | 0.00 | 87.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 14.00 | 0.00 | 86.00 | 0.00 | 86.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 15.00 | 0.00 | 85.00 | 0.00 | 85.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 16.00 | 0.00 | 84.00 | 0.00 | 84.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 17.00 | 0.00 | 83.00 | 0.00 | 83.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 18.00 | 0.00 | 82.00 | 0.00 | 82.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 19.00 | 0.00 | 81.00 | 0.00 | 81.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 20.00 | 0.00 | 80.00 | 0.00 | 80.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 21.00 | 0.00 | 79.00 | 0.00 | 79.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 22.00 | 0.00 | 78.00 | 0.00 | 78.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 23.00 | 0.00 | 77.00 | 0.00 | 77.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 24.00 | 0.00 | 76.00 | 0.00 | 76.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 25.00 | 0.00 | 75.00 | 0.00 | 75.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 26.00 | 0.00 | 74.00 | 0.00 | 74.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 27.00 | 0.00 | 73.00 | 0.00 | 73.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 28.00 | 0.00 | 72.00 | 0.00 | 72.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 29.00 | 0.00 | 71.00 | 0.00 | 71.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 30.00 | 0.00 | 70.00 | 0.00 | 70.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 31.00 | 0.00 | 69.00 | 0.00 | 69.00 | 0.00 | -1.00 | 0.0000 | -0.0000 |

| 32.00 | 0.00 | 68.00 | 0.00 | 68.00 | 0.00 | -1.00 | 0.0001 | -0.0000 |

| 33.00 | 0.00 | 67.00 | 0.00 | 67.00 | 0.00 | -1.00 | 0.0001 | -0.0000 |

| 34.00 | 0.00 | 66.00 | 0.00 | 66.00 | 0.00 | -1.00 | 0.0001 | -0.0000 |

| 35.00 | 0.00 | 65.00 | 0.00 | 65.00 | 0.00 | -1.00 | 0.0001 | -0.0000 |

| 36.00 | 0.00 | 64.00 | 0.00 | 64.00 | 0.00 | -1.00 | 0.0002 | -0.0000 |

| 37.00 | 0.00 | 63.00 | 0.00 | 63.00 | 0.00 | -1.00 | 0.0002 | -0.0000 |

| 38.00 | 0.00 | 62.00 | 0.00 | 62.00 | 0.00 | -1.00 | 0.0003 | -0.0001 |

| 39.00 | 0.00 | 61.00 | 0.00 | 61.00 | 0.00 | -1.00 | 0.0004 | -0.0001 |

| 40.00 | 0.00 | 60.00 | 0.01 | 60.01 | 0.00 | -1.00 | 0.0005 | -0.0001 |

| 41.00 | 0.00 | 59.00 | 0.01 | 59.01 | 0.00 | -1.00 | 0.0006 | -0.0001 |

| 42.00 | 0.00 | 58.00 | 0.01 | 58.01 | 0.00 | -1.00 | 0.0007 | -0.0002 |

| 43.00 | 0.00 | 57.00 | 0.01 | 57.01 | 0.00 | -1.00 | 0.0009 | -0.0002 |

| 44.00 | 0.00 | 56.00 | 0.02 | 56.02 | 0.00 | -1.00 | 0.0011 | -0.0003 |

| 45.00 | 0.00 | 55.00 | 0.02 | 55.02 | 0.01 | -0.99 | 0.0013 | -0.0003 |

| 46.00 | 0.00 | 54.00 | 0.03 | 54.03 | 0.01 | -0.99 | 0.0015 | -0.0004 |

| 47.00 | 0.00 | 53.00 | 0.04 | 53.04 | 0.01 | -0.99 | 0.0017 | -0.0005 |

| 48.00 | 0.00 | 52.00 | 0.05 | 52.05 | 0.01 | -0.99 | 0.0020 | -0.0006 |

| 49.00 | 0.00 | 51.00 | 0.06 | 51.06 | 0.01 | -0.99 | 0.0023 | -0.0007 |

| 50.00 | 0.00 | 50.00 | 0.07 | 50.07 | 0.02 | -0.98 | 0.0026 | -0.0008 |

| 51.00 | 0.00 | 49.00 | 0.09 | 49.09 | 0.02 | -0.98 | 0.0029 | -0.0009 |

| 52.00 | 0.00 | 48.00 | 0.11 | 48.11 | 0.02 | -0.98 | 0.0033 | -0.0011 |

| 53.00 | 0.00 | 47.00 | 0.13 | 47.13 | 0.02 | -0.98 | 0.0036 | -0.0013 |

| 54.00 | 0.00 | 46.00 | 0.16 | 46.16 | 0.03 | -0.97 | 0.0040 | -0.0014 |

| 55.00 | 0.00 | 45.00 | 0.19 | 45.19 | 0.03 | -0.97 | 0.0044 | -0.0017 |

| 56.00 | 0.00 | 44.00 | 0.23 | 44.23 | 0.04 | -0.96 | 0.0048 | -0.0019 |

| 57.00 | 0.00 | 43.00 | 0.27 | 43.27 | 0.04 | -0.96 | 0.0053 | -0.0021 |

| 58.00 | 0.00 | 42.00 | 0.31 | 42.31 | 0.05 | -0.95 | 0.0057 | -0.0024 |

| 59.00 | 0.00 | 41.00 | 0.36 | 41.36 | 0.05 | -0.95 | 0.0062 | -0.0027 |

| 60.00 | 0.00 | 40.00 | 0.42 | 40.42 | 0.06 | -0.94 | 0.0066 | -0.0029 |

| 61.00 | 0.00 | 39.00 | 0.48 | 39.48 | 0.07 | -0.93 | 0.0071 | -0.0033 |

| 62.00 | 0.00 | 38.00 | 0.55 | 38.55 | 0.07 | -0.93 | 0.0076 | -0.0036 |

| 63.00 | 0.00 | 37.00 | 0.63 | 37.63 | 0.08 | -0.92 | 0.0080 | -0.0039 |

| 64.00 | 0.00 | 36.00 | 0.72 | 36.72 | 0.09 | -0.91 | 0.0085 | -0.0043 |

| 65.00 | 0.00 | 35.00 | 0.81 | 35.81 | 0.10 | -0.90 | 0.0089 | -0.0047 |

| 66.00 | 0.00 | 34.00 | 0.92 | 34.92 | 0.11 | -0.89 | 0.0094 | -0.0050 |

| 67.00 | 0.00 | 33.00 | 1.03 | 34.03 | 0.12 | -0.88 | 0.0098 | -0.0054 |

| 68.00 | 0.00 | 32.00 | 1.15 | 33.15 | 0.13 | -0.87 | 0.0103 | -0.0059 |

| 69.00 | 0.00 | 31.00 | 1.29 | 32.29 | 0.14 | -0.86 | 0.0107 | -0.0063 |

| 70.00 | 0.00 | 30.00 | 1.43 | 31.43 | 0.15 | -0.85 | 0.0111 | -0.0067 |

| 71.00 | 0.00 | 29.00 | 1.58 | 30.58 | 0.16 | -0.84 | 0.0115 | -0.0071 |

| 72.00 | 0.00 | 28.00 | 1.75 | 29.75 | 0.17 | -0.83 | 0.0118 | -0.0076 |

| 73.00 | 0.00 | 27.00 | 1.93 | 28.93 | 0.18 | -0.82 | 0.0122 | -0.0080 |

| 74.00 | 0.00 | 26.00 | 2.12 | 28.12 | 0.20 | -0.80 | 0.0125 | -0.0084 |

| 75.00 | 0.00 | 25.00 | 2.32 | 27.32 | 0.21 | -0.79 | 0.0128 | -0.0089 |

| 76.00 | 0.00 | 24.00 | 2.54 | 26.54 | 0.22 | -0.78 | 0.0131 | -0.0093 |

| 77.00 | 0.00 | 23.00 | 2.77 | 25.77 | 0.24 | -0.76 | 0.0133 | -0.0097 |

| 78.00 | 0.00 | 22.00 | 3.01 | 25.01 | 0.25 | -0.75 | 0.0135 | -0.0102 |

| 79.00 | 0.00 | 21.00 | 3.27 | 24.27 | 0.26 | -0.74 | 0.0138 | -0.0106 |

| 80.00 | 0.00 | 20.00 | 3.53 | 23.53 | 0.28 | -0.72 | 0.0139 | -0.0110 |

| 81.00 | 0.00 | 19.00 | 3.82 | 22.82 | 0.29 | -0.71 | 0.0141 | -0.0114 |

| 82.00 | 0.00 | 18.00 | 4.12 | 22.12 | 0.30 | -0.70 | 0.0142 | -0.0118 |

| 83.00 | 0.00 | 17.00 | 4.43 | 21.43 | 0.32 | -0.68 | 0.0143 | -0.0122 |

| 84.00 | 0.00 | 16.00 | 4.75 | 20.75 | 0.33 | -0.67 | 0.0144 | -0.0125 |

| 85.00 | 0.00 | 15.00 | 5.09 | 20.09 | 0.35 | -0.65 | 0.0145 | -0.0129 |

| 86.00 | 0.00 | 14.00 | 5.45 | 19.45 | 0.36 | -0.64 | 0.0145 | -0.0132 |

| 87.00 | 0.00 | 13.00 | 5.82 | 18.82 | 0.38 | -0.62 | 0.0145 | -0.0136 |

| 88.00 | 0.00 | 12.00 | 6.20 | 18.20 | 0.39 | -0.61 | 0.0145 | -0.0139 |

| 89.00 | 0.00 | 11.00 | 6.60 | 17.60 | 0.41 | -0.59 | 0.0145 | -0.0142 |

| 90.00 | 0.00 | 10.00 | 7.01 | 17.01 | 0.42 | -0.58 | 0.0145 | -0.0145 |

| 91.00 | 0.00 | 9.00 | 7.44 | 16.44 | 0.43 | -0.57 | 0.0144 | -0.0147 |

| 92.00 | 0.00 | 8.00 | 7.88 | 15.88 | 0.45 | -0.55 | 0.0143 | -0.0150 |

| 93.00 | 0.00 | 7.00 | 8.34 | 15.34 | 0.46 | -0.54 | 0.0142 | -0.0152 |

| 94.00 | 0.00 | 6.00 | 8.81 | 14.81 | 0.48 | -0.52 | 0.0141 | -0.0154 |

| 95.00 | 0.00 | 5.00 | 9.29 | 14.29 | 0.49 | -0.51 | 0.0140 | -0.0156 |

| 96.00 | 0.00 | 4.00 | 9.79 | 13.79 | 0.51 | -0.49 | 0.0139 | -0.0157 |

| 97.00 | 0.00 | 3.00 | 10.30 | 13.30 | 0.52 | -0.48 | 0.0137 | -0.0159 |

| 98.00 | 0.01 | 2.01 | 10.83 | 12.83 | 0.53 | -0.47 | 0.0135 | -0.0160 |

| 99.00 | 0.08 | 1.08 | 11.37 | 12.37 | 0.55 | -0.45 | 0.0133 | -0.0161 |

| 100.00 | 0.40 | 0.40 | 11.92 | 11.92 | 0.56 | -0.44 | 0.0131 | -0.0162 |

| 101.00 | 1.08 | 0.08 | 12.49 | 11.49 | 0.57 | -0.43 | 0.0129 | -0.0163 |

| 102.00 | 2.01 | 0.01 | 13.07 | 11.07 | 0.59 | -0.41 | 0.0127 | -0.0163 |

| 103.00 | 3.00 | 0.00 | 13.66 | 10.66 | 0.60 | -0.40 | 0.0125 | -0.0164 |

| 104.00 | 4.00 | 0.00 | 14.27 | 10.27 | 0.61 | -0.39 | 0.0123 | -0.0164 |

| 105.00 | 5.00 | 0.00 | 14.88 | 9.88 | 0.62 | -0.38 | 0.0121 | -0.0164 |

| 106.00 | 6.00 | 0.00 | 15.51 | 9.51 | 0.63 | -0.37 | 0.0118 | -0.0164 |

| 107.00 | 7.00 | 0.00 | 16.15 | 9.15 | 0.65 | -0.35 | 0.0116 | -0.0163 |

| 108.00 | 8.00 | 0.00 | 16.80 | 8.80 | 0.66 | -0.34 | 0.0113 | -0.0163 |

| 109.00 | 9.00 | 0.00 | 17.47 | 8.47 | 0.67 | -0.33 | 0.0111 | -0.0162 |

| 110.00 | 10.00 | 0.00 | 18.14 | 8.14 | 0.68 | -0.32 | 0.0108 | -0.0162 |

| 111.00 | 11.00 | 0.00 | 18.83 | 7.83 | 0.69 | -0.31 | 0.0106 | -0.0161 |

| 112.00 | 12.00 | 0.00 | 19.52 | 7.52 | 0.70 | -0.30 | 0.0103 | -0.0160 |

| 113.00 | 13.00 | 0.00 | 20.23 | 7.23 | 0.71 | -0.29 | 0.0101 | -0.0159 |

| 114.00 | 14.00 | 0.00 | 20.95 | 6.95 | 0.72 | -0.28 | 0.0098 | -0.0157 |

| 115.00 | 15.00 | 0.00 | 21.67 | 6.67 | 0.73 | -0.27 | 0.0096 | -0.0156 |

| 116.00 | 16.00 | 0.00 | 22.41 | 6.41 | 0.74 | -0.26 | 0.0093 | -0.0154 |

| 117.00 | 17.00 | 0.00 | 23.15 | 6.15 | 0.75 | -0.25 | 0.0091 | -0.0153 |

| 118.00 | 18.00 | 0.00 | 23.91 | 5.91 | 0.76 | -0.24 | 0.0088 | -0.0151 |

| 119.00 | 19.00 | 0.00 | 24.67 | 5.67 | 0.77 | -0.23 | 0.0086 | -0.0149 |

| 120.00 | 20.00 | 0.00 | 25.44 | 5.44 | 0.78 | -0.22 | 0.0083 | -0.0148 |

| 121.00 | 21.00 | 0.00 | 26.22 | 5.22 | 0.78 | -0.22 | 0.0081 | -0.0146 |

| 122.00 | 22.00 | 0.00 | 27.01 | 5.01 | 0.79 | -0.21 | 0.0078 | -0.0144 |

| 123.00 | 23.00 | 0.00 | 27.80 | 4.80 | 0.80 | -0.20 | 0.0076 | -0.0142 |

| 124.00 | 24.00 | 0.00 | 28.61 | 4.61 | 0.81 | -0.19 | 0.0074 | -0.0140 |

| 125.00 | 25.00 | 0.00 | 29.42 | 4.42 | 0.81 | -0.19 | 0.0071 | -0.0137 |

| 126.00 | 26.00 | 0.00 | 30.24 | 4.24 | 0.82 | -0.18 | 0.0069 | -0.0135 |

| 127.00 | 27.00 | 0.00 | 31.06 | 4.06 | 0.83 | -0.17 | 0.0067 | -0.0133 |

| 128.00 | 28.00 | 0.00 | 31.89 | 3.89 | 0.83 | -0.17 | 0.0065 | -0.0131 |

| 129.00 | 29.00 | 0.00 | 32.73 | 3.73 | 0.84 | -0.16 | 0.0063 | -0.0128 |

| 130.00 | 30.00 | 0.00 | 33.57 | 3.57 | 0.85 | -0.15 | 0.0061 | -0.0126 |

| 131.00 | 31.00 | 0.00 | 34.42 | 3.42 | 0.85 | -0.15 | 0.0058 | -0.0124 |

| 132.00 | 32.00 | 0.00 | 35.28 | 3.28 | 0.86 | -0.14 | 0.0057 | -0.0121 |

| 133.00 | 33.00 | 0.00 | 36.14 | 3.14 | 0.86 | -0.14 | 0.0055 | -0.0119 |

| 134.00 | 34.00 | 0.00 | 37.01 | 3.01 | 0.87 | -0.13 | 0.0053 | -0.0117 |

| 135.00 | 35.00 | 0.00 | 37.88 | 2.88 | 0.87 | -0.13 | 0.0051 | -0.0114 |

| 136.00 | 36.00 | 0.00 | 38.76 | 2.76 | 0.88 | -0.12 | 0.0049 | -0.0112 |

| 137.00 | 37.00 | 0.00 | 39.64 | 2.64 | 0.88 | -0.12 | 0.0047 | -0.0109 |

| 138.00 | 38.00 | 0.00 | 40.53 | 2.53 | 0.89 | -0.11 | 0.0046 | -0.0107 |

| 139.00 | 39.00 | 0.00 | 41.42 | 2.42 | 0.89 | -0.11 | 0.0044 | -0.0105 |

| 140.00 | 40.00 | 0.00 | 42.32 | 2.32 | 0.90 | -0.10 | 0.0042 | -0.0102 |

| 141.00 | 41.00 | 0.00 | 43.22 | 2.22 | 0.90 | -0.10 | 0.0041 | -0.0100 |

| 142.00 | 42.00 | 0.00 | 44.12 | 2.12 | 0.91 | -0.09 | 0.0039 | -0.0098 |

| 143.00 | 43.00 | 0.00 | 45.03 | 2.03 | 0.91 | -0.09 | 0.0038 | -0.0095 |

| 144.00 | 44.00 | 0.00 | 45.94 | 1.94 | 0.91 | -0.09 | 0.0036 | -0.0093 |

| 145.00 | 45.00 | 0.00 | 46.86 | 1.86 | 0.92 | -0.08 | 0.0035 | -0.0091 |

| 146.00 | 46.00 | 0.00 | 47.78 | 1.78 | 0.92 | -0.08 | 0.0034 | -0.0088 |

| 147.00 | 47.00 | 0.00 | 48.70 | 1.70 | 0.92 | -0.08 | 0.0032 | -0.0086 |

| 148.00 | 48.00 | 0.00 | 49.63 | 1.63 | 0.93 | -0.07 | 0.0031 | -0.0084 |

| 149.00 | 49.00 | 0.00 | 50.55 | 1.55 | 0.93 | -0.07 | 0.0030 | -0.0082 |

| 150.00 | 50.00 | 0.00 | 51.49 | 1.49 | 0.93 | -0.07 | 0.0029 | -0.0080 |

| 151.00 | 51.00 | 0.00 | 52.42 | 1.42 | 0.94 | -0.06 | 0.0028 | -0.0078 |

| 152.00 | 52.00 | 0.00 | 53.36 | 1.36 | 0.94 | -0.06 | 0.0026 | -0.0075 |

| 153.00 | 53.00 | 0.00 | 54.30 | 1.30 | 0.94 | -0.06 | 0.0025 | -0.0073 |

| 154.00 | 54.00 | 0.00 | 55.24 | 1.24 | 0.94 | -0.06 | 0.0024 | -0.0071 |

| 155.00 | 55.00 | 0.00 | 56.19 | 1.19 | 0.95 | -0.05 | 0.0023 | -0.0069 |

| 156.00 | 56.00 | 0.00 | 57.13 | 1.13 | 0.95 | -0.05 | 0.0022 | -0.0067 |

| 157.00 | 57.00 | 0.00 | 58.08 | 1.08 | 0.95 | -0.05 | 0.0022 | -0.0066 |

| 158.00 | 58.00 | 0.00 | 59.04 | 1.04 | 0.95 | -0.05 | 0.0021 | -0.0064 |

| 159.00 | 59.00 | 0.00 | 59.99 | 0.99 | 0.96 | -0.04 | 0.0020 | -0.0062 |

| 160.00 | 60.00 | 0.00 | 60.95 | 0.95 | 0.96 | -0.04 | 0.0019 | -0.0060 |

| 161.00 | 61.00 | 0.00 | 61.90 | 0.90 | 0.96 | -0.04 | 0.0018 | -0.0058 |

| 162.00 | 62.00 | 0.00 | 62.86 | 0.86 | 0.96 | -0.04 | 0.0018 | -0.0057 |

| 163.00 | 63.00 | 0.00 | 63.82 | 0.82 | 0.96 | -0.04 | 0.0017 | -0.0055 |

| 164.00 | 64.00 | 0.00 | 64.79 | 0.79 | 0.96 | -0.04 | 0.0016 | -0.0053 |

| 165.00 | 65.00 | 0.00 | 65.75 | 0.75 | 0.97 | -0.03 | 0.0015 | -0.0052 |

| 166.00 | 66.00 | 0.00 | 66.72 | 0.72 | 0.97 | -0.03 | 0.0015 | -0.0050 |

| 167.00 | 67.00 | 0.00 | 67.69 | 0.69 | 0.97 | -0.03 | 0.0014 | -0.0049 |

| 168.00 | 68.00 | 0.00 | 68.66 | 0.66 | 0.97 | -0.03 | 0.0014 | -0.0047 |

| 169.00 | 69.00 | 0.00 | 69.63 | 0.63 | 0.97 | -0.03 | 0.0013 | -0.0046 |

| 170.00 | 70.00 | 0.00 | 70.60 | 0.60 | 0.97 | -0.03 | 0.0012 | -0.0044 |

| 171.00 | 71.00 | 0.00 | 71.57 | 0.57 | 0.97 | -0.03 | 0.0012 | -0.0043 |

| 172.00 | 72.00 | 0.00 | 72.55 | 0.55 | 0.97 | -0.03 | 0.0011 | -0.0041 |

| 173.00 | 73.00 | 0.00 | 73.52 | 0.52 | 0.98 | -0.02 | 0.0011 | -0.0040 |

| 174.00 | 74.00 | 0.00 | 74.50 | 0.50 | 0.98 | -0.02 | 0.0010 | -0.0039 |

| 175.00 | 75.00 | 0.00 | 75.48 | 0.48 | 0.98 | -0.02 | 0.0010 | -0.0038 |

| 176.00 | 76.00 | 0.00 | 76.45 | 0.45 | 0.98 | -0.02 | 0.0010 | -0.0036 |

| 177.00 | 77.00 | 0.00 | 77.43 | 0.43 | 0.98 | -0.02 | 0.0009 | -0.0035 |

| 178.00 | 78.00 | 0.00 | 78.41 | 0.41 | 0.98 | -0.02 | 0.0009 | -0.0034 |

| 179.00 | 79.00 | 0.00 | 79.40 | 0.40 | 0.98 | -0.02 | 0.0008 | -0.0033 |

| 180.00 | 80.00 | 0.00 | 80.38 | 0.38 | 0.98 | -0.02 | 0.0008 | -0.0032 |

| 181.00 | 81.00 | 0.00 | 81.36 | 0.36 | 0.98 | -0.02 | 0.0008 | -0.0031 |

| 182.00 | 82.00 | 0.00 | 82.34 | 0.34 | 0.98 | -0.02 | 0.0007 | -0.0030 |

| 183.00 | 83.00 | 0.00 | 83.33 | 0.33 | 0.98 | -0.02 | 0.0007 | -0.0029 |

| 184.00 | 84.00 | 0.00 | 84.31 | 0.31 | 0.99 | -0.01 | 0.0007 | -0.0028 |

| 185.00 | 85.00 | 0.00 | 85.30 | 0.30 | 0.99 | -0.01 | 0.0006 | -0.0027 |

| 186.00 | 86.00 | 0.00 | 86.29 | 0.29 | 0.99 | -0.01 | 0.0006 | -0.0026 |

| 187.00 | 87.00 | 0.00 | 87.27 | 0.27 | 0.99 | -0.01 | 0.0006 | -0.0025 |

| 188.00 | 88.00 | 0.00 | 88.26 | 0.26 | 0.99 | -0.01 | 0.0006 | -0.0024 |

| 189.00 | 89.00 | 0.00 | 89.25 | 0.25 | 0.99 | -0.01 | 0.0005 | -0.0023 |

| 190.00 | 90.00 | 0.00 | 90.24 | 0.24 | 0.99 | -0.01 | 0.0005 | -0.0023 |

| 191.00 | 91.00 | 0.00 | 91.23 | 0.23 | 0.99 | -0.01 | 0.0005 | -0.0022 |

| 192.00 | 92.00 | 0.00 | 92.22 | 0.22 | 0.99 | -0.01 | 0.0005 | -0.0021 |

| 193.00 | 93.00 | 0.00 | 93.21 | 0.21 | 0.99 | -0.01 | 0.0004 | -0.0020 |

| 194.00 | 94.00 | 0.00 | 94.20 | 0.20 | 0.99 | -0.01 | 0.0004 | -0.0020 |

| 195.00 | 95.00 | 0.00 | 95.19 | 0.19 | 0.99 | -0.01 | 0.0004 | -0.0019 |

| 196.00 | 96.00 | 0.00 | 96.18 | 0.18 | 0.99 | -0.01 | 0.0004 | -0.0018 |

| 197.00 | 97.00 | 0.00 | 97.17 | 0.17 | 0.99 | -0.01 | 0.0004 | -0.0018 |

| 198.00 | 98.00 | 0.00 | 98.16 | 0.16 | 0.99 | -0.01 | 0.0004 | -0.0017 |

| 199.00 | 99.00 | 0.00 | 99.16 | 0.16 | 0.99 | -0.01 | 0.0003 | -0.0016 |

| 200.00 | 100.00 | 0.00 | 100.15 | 0.15 | 0.99 | -0.01 | 0.0003 | -0.0016 |

Greeks

- Delta: measures the sensitivity of an option’s price to changes in the underlying asset’s price.

Gamma: measures the rate of change in an option’s delta to changes in the underlying asset’s price.

Vega: measures the sensitivity of an option’s price to changes in the volatility of the underlying asset.

Theta: measures the sensitivity of an option’s price to the passage of time.

Rho: measures the sensitivity of an option’s price to changes in the interest rate.

Delta Charts

Gamma and Theta Charts

Hedging

Hedging reduces exposure for possible future scenarios. Price changes are the main risk factor.

Static hedge: hedged portfolio’s risk profile does not change materially over possible future scenarios.

futures vs physical exposure.

put-call parity: call - put = underlying - strike

Dynamic hedge: delta hedging and re-hedging as required

- futures option vs futures.

Dynamic Hedging

Positive gamma lead to natural buy low sell high re-hedging trades and produce hedging profit.

Option loses time value as time to expiration reduces.

Gamma vs Theta trade-off

Option increase in value as volatility/uncertainty increases.

Implied volatility vs realized volatility

Benefits

Payoff asymmetry: limited loss from long options

Leverage: option premium is a fraction of underlying asset price

Express view of any market condition: bull, bear, range bounding

Risks

Unlimited loss

Margin calls

Complexity

WTI Option

WTI (West Texas Intermediate, a US light sweet crude oil blend) futures provide direct crude oil exposure

Hedge against adverse oil price moves or speculate

Price discovery

American style call/put

Source CME WTI Option Specs

Crude Oil Futures Settlements

Crude Oil Futures Option Settlements

Natual Gas Option

Natual Gas Futures Settlements

Natural Gas Futures Option Settlements

Corn Option

Deliverable into Corn Futures, American style call/put

Listed Contracts:

- Monthly contracts listed for 4 consecutive months and:

- 3 monthly contracts of Mar listed in July

- 3 monthly contracts of May listed in September

- 3 monthly contracts of Sep listed in March

- 7 monthly contracts of Jul and Dec listed in November

Source CME Corn Option Specs

Corn Futures Settlements

Corn Futures Option Settlements

Soybean Option

Soybean Futures Settlements

Soybean Futures Option Settlements

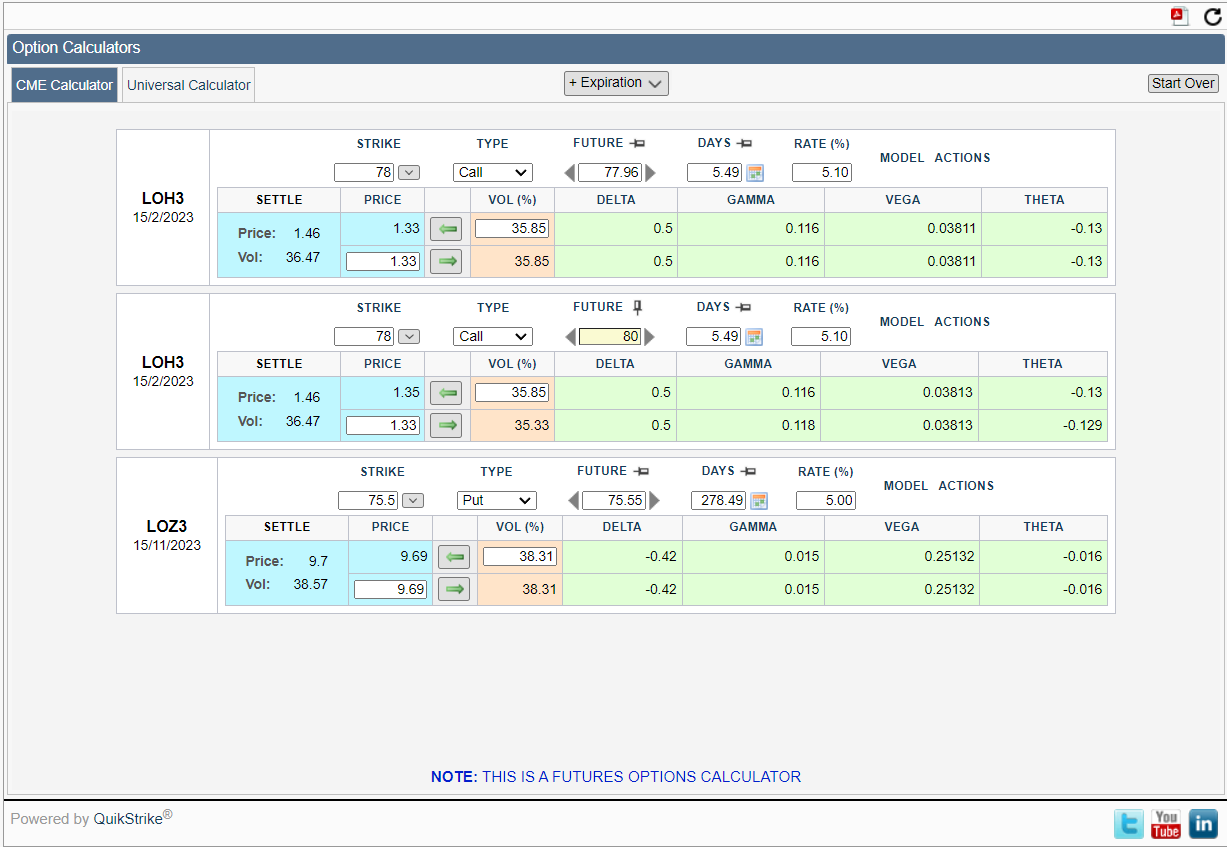

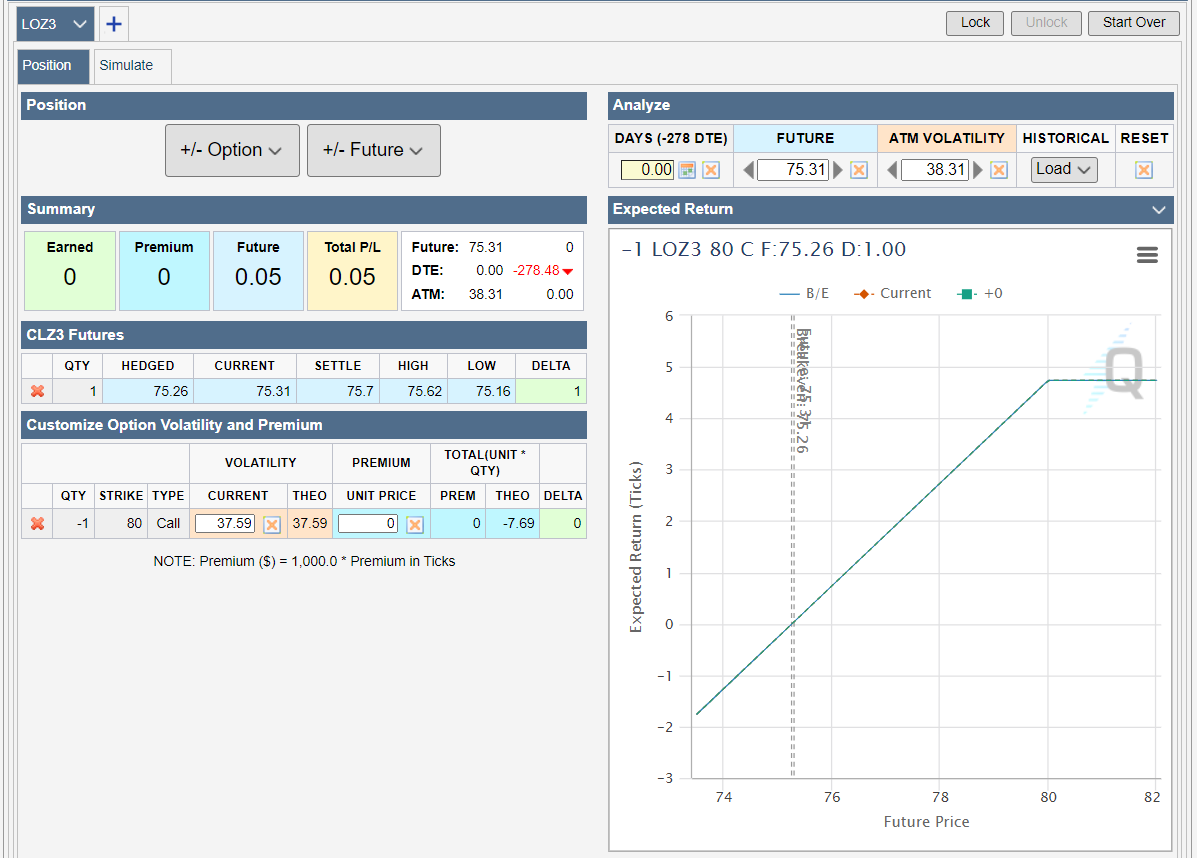

Live Calculator

Source CME

Strategies

Combinations of various options and underlying asset can be used to meet different payoff requirements

Common Strategies

covered calls

call spreads

straddle/strangle

Covered call example

Source CME

Trading

- Who trades options?

- How to trade options?

Market mechanism

Listed vs OTC market

Market Participants

Margin Requirements

Exercising / Assignments

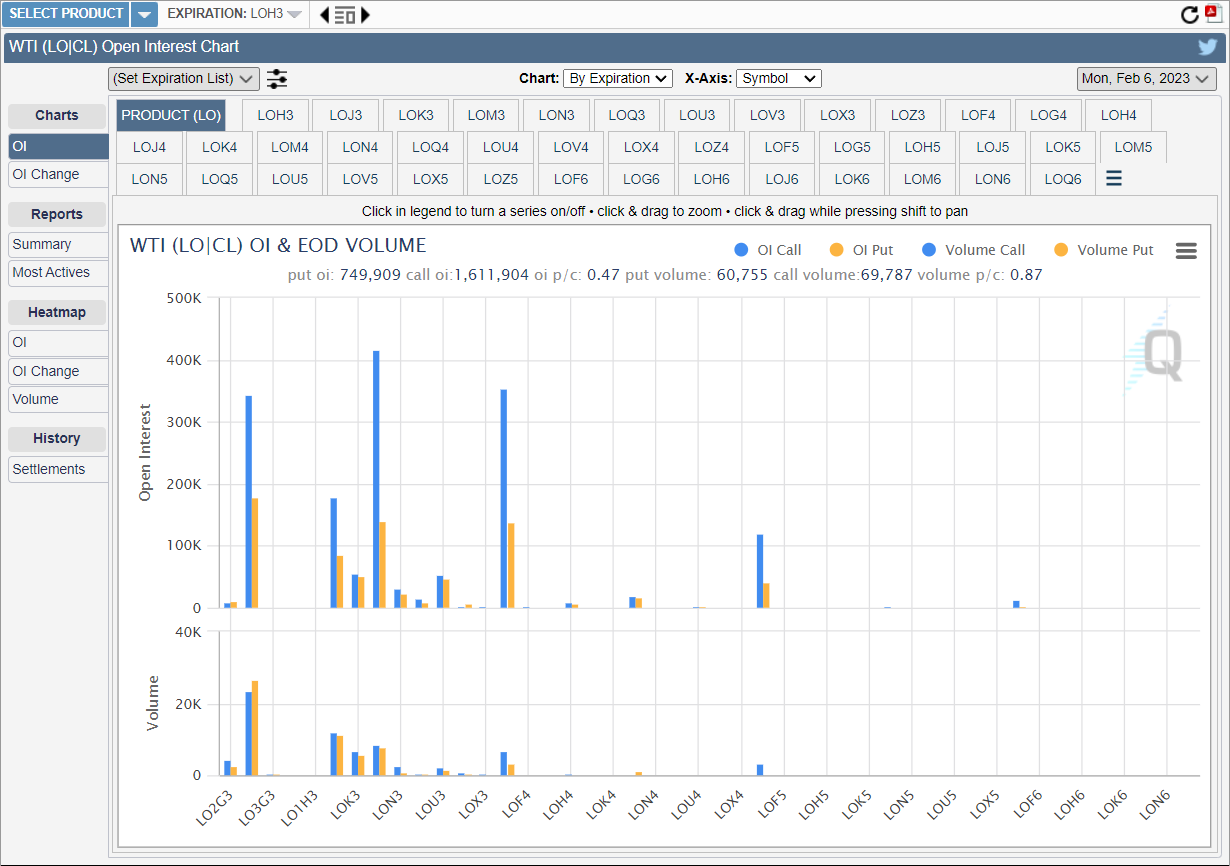

Open Interest

Source CME

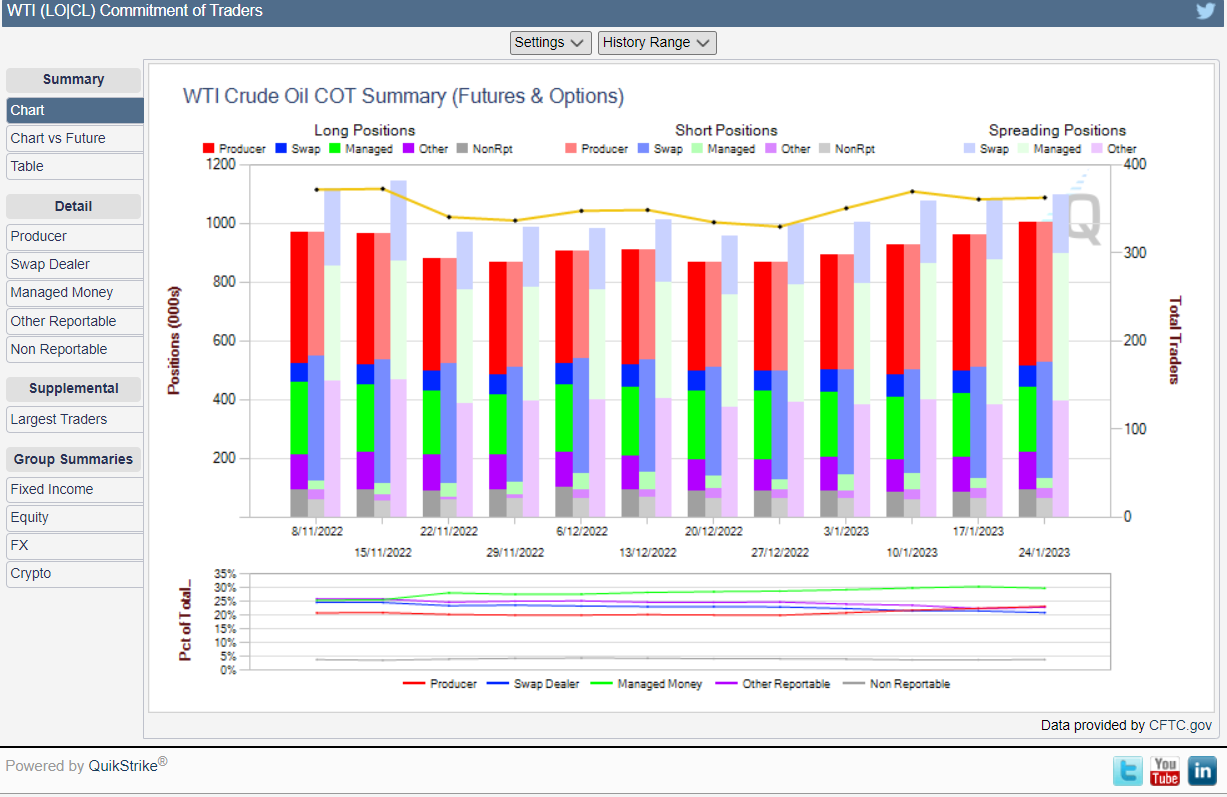

Commitments of Traders Report

- Producer/Merchant/Processor/User

- A “producer/merchant/processor/user” is an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage or hedge risks associated with those activities.

- Swap Dealer

- A “swap dealer” is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions. The swap dealer’s counterparties may be speculative traders, like hedge funds, or traditional commercial clients that are managing risk arising from their dealings in the physical commodity.

- Money Manager

- A “money manager,” for the purpose of this report, is a registered commodity trading advisor (CTA); a registered commodity pool operator (CPO); or an unregistered fund identified by CFTC.7 These traders are engaged in managing and conducting organized futures trading on behalf of clients.

Conclusion

- What is option

- Option pricing factors

- Benefits and risk

- Option market